Your Total Guide to Acquiring a Home Stress-Free

Browsing the home-buying process can often really feel frustrating, yet it does not have to be. By concentrating on vital actions such as evaluating your financial readiness, researching ideal neighborhoods, and securing home loan pre-approval, you can simplify the experience.

Examining Your Monetary Preparedness

Evaluating your monetary preparedness is a critical action in the home-buying process. Before starting this significant financial investment, it is necessary to review your economic wellness comprehensively. Begin by examining your credit history, as it straight influences home mortgage eligibility and passion prices. A score above 740 commonly qualifies for desirable funding terms, while reduced scores may require improvements.

A down settlement of 20% is commonly recommended to stay clear of personal mortgage insurance (PMI) and protect better loan conditions. Additionally, variable in closing costs, which can range from 2% to 5% of the home cost.

Analyze your monthly budget plan to guarantee you can easily accommodate home loan payments, building tax obligations, insurance coverage, and maintenance costs. By extensively examining these economic elements, you position on your own to make educated choices and improve your likelihood of a effective and trouble-free home-buying experience.

Researching Neighborhoods and Quality

Use online tools and sources to assess neighborhood stats, consisting of crime prices, residential or commercial property values, and institution rankings. Sites such as Zillow, Realtor.com, and local property listings can provide important insights into the marketplace patterns and readily available properties.

Seeing communities in individual is equally essential. Take time to discover the location during different times of the day to gauge activity levels and area vibes. Involve with regional citizens to collect first-hand information concerning living in the area.

In addition, think about future developments that might affect residential or commercial property worths, such as new framework jobs or zoning modifications. Finally, make a list of preferred residential or commercial properties and examine them based upon your research, making certain each lines up with your recognized criteria. This diligent method will empower you to make educated choices and discover a home that perfectly fits your requirements.

Obtaining Pre-Approved for a Home Loan

Protecting a mortgage pre-approval is a crucial action in the home-buying procedure, supplying you with quality on your budget plan and demonstrating to sellers that you are a major buyer - Real Estate Melbourne For Sale. Throughout this process, lenders evaluate your monetary scenario, including your debt score, revenue, financial debts, and properties, to figure out just how much they agree to offer you

To begin, gather needed paperwork such as income tax return, pay stubs, financial institution declarations, and any kind of other pertinent monetary records. This details will help simplify the pre-approval procedure and ensure an extra accurate assessment of your borrowing capacity. As soon as you send your application, the lending institution will certainly review your qualifications and might release a pre-approval letter, specifying the financing quantity you get.

Having a pre-approval letter in hand not just enhances your placement when making deals however likewise helps you avoid possible dissatisfaction later at the same time. It offers you redirected here a reasonable view of what you can manage and narrows your home search to residential properties within your economic reach. Eventually, obtaining a mortgage pre-approval is a crucial step that simplifies your home-buying journey.

Browsing the Home Purchasing Refine

With your home loan pre-approval in hand, the next phase of your home-buying trip includes navigating the different actions causing an effective purchase. The initial step is to specify your standards for the optimal home, including area, size, and features. This clearness will simplify your search and help you concentrate on homes that satisfy your demands.

Next, employ the help of a reliable property representative who understands your preferences and local market patterns. They can give useful insights, schedule viewings, and work out on your part. Conduct comprehensive examinations to evaluate their condition and determine any type of red flags. once you identify prospective homes.

When you find a building that reverberates with you, submit a competitive deal. Be planned for arrangements, as the seller may counter your proposal. After your offer is accepted, you'll enter the due persistance phase, where you'll evaluate disclosures and agreements, finalize your funding, and safe and secure essential inspections.

Throughout this procedure, keep open communication with your representative and remain versatile (House For Sale In Ivanhoe). By being arranged and aggressive, you can navigate the home-buying process with confidence and relocate better to finding your desire home

Wrapping Up the Purchase and Relocating In

As you come close to the last phases of your home-buying trip, it's necessary to ensure that all necessary paperwork remains in order and that you are gotten ready for the closing process. This typically involves a series of steps finishing in the closing meeting, where you'll authorize different legal records, finalize your home mortgage, and pay closing prices.

Before the closing day, evaluate the closing disclosure, redirected here which describes your financing terms, month-to-month settlements, and all closing prices. Validate that these figures align with your expectations. It's also important to carry out a last walkthrough of the residential or commercial property to confirm that it is in the agreed-upon problem.

On the closing go to the website day, be prepared to give recognition and any type of superior papers. After signing the papers, you will certainly get the tricks to your new home.

Unloading efficiently will aid you resolve in even more easily, allowing you to genuinely enjoy your new home. By following these final actions, you can guarantee a stress-free and smooth transition into homeownership.

Verdict

Finally, an organized strategy to buying a house can dramatically reduce stress and anxiety and improve the overall experience. By extensively evaluating financial readiness, performing comprehensive community study, protecting home loan pre-approval, and successfully browsing the buying process, prospective house owners can attain their goals with greater simplicity. Attention to detail during completion and relocating processes better guarantees a smooth shift right into a brand-new home, ultimately cultivating a feeling of achievement and security in homeownership.

Michael Bower Then & Now!

Michael Bower Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Morgan Fairchild Then & Now!

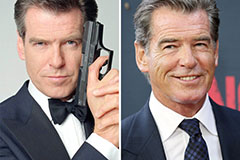

Morgan Fairchild Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!